SOL Price Prediction: How High Will It Go?

#SOL

- SOL shows mixed technical signals with bullish MACD but price below key moving average

- Market sentiment is divided with both positive developments and competitive threats emerging

- Key price levels to watch are $154 (support) and $178 (resistance)

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

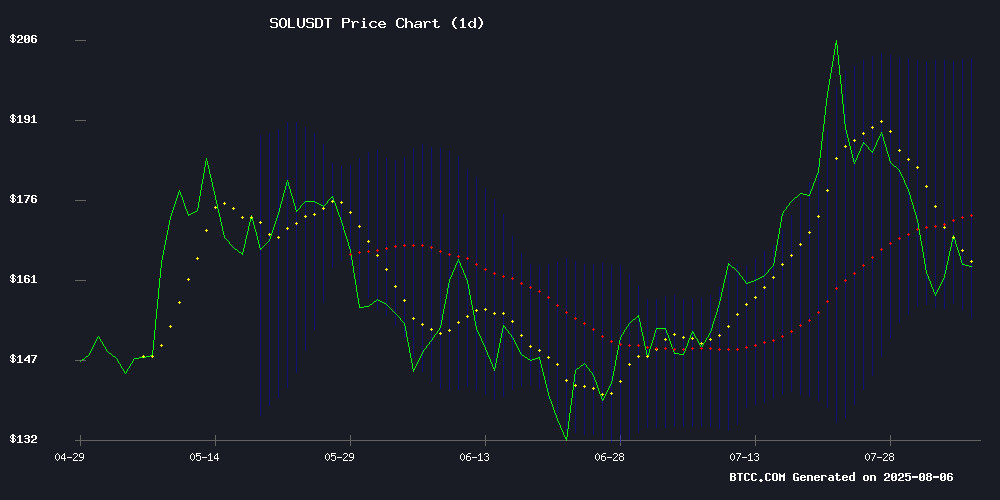

According to BTCC financial analyst Olivia, SOL is currently trading at $163.86, below its 20-day moving average of $178.24, indicating potential short-term bearish pressure. The MACD shows a bullish crossover with the histogram at 11.4006, suggesting upward momentum. Bollinger Bands reveal SOL is NEAR the lower band at $154.19, which could act as support. Olivia notes that a break above the middle band at $178.24 may signal a trend reversal.

Market Sentiment: Mixed Signals for SOL

BTCC financial analyst Olivia highlights conflicting market sentiment for SOL. While Grok AI's prediction of a 'Solana Killer' altcoin and resistance at $100 pose bearish risks, positive developments like Upexi Inc. doubling its SOL holdings and solana Mobile's global rollout of its crypto smartphone could fuel bullish momentum. Olivia emphasizes that these factors must be weighed against technical indicators for a balanced view.

Factors Influencing SOL’s Price

Grok AI Predicts 'Solana Killer' Altcoin Could Eclipse SOL's Market Position

Unilabs Finance emerges as a formidable challenger to Solana, leveraging AI-powered features and rapid presale growth to capture investor attention. Grok AI's endorsement as a potential 'Solana Killer' has intensified competition in the blockchain ecosystem, prompting SOL holders to diversify into utility-driven alternatives.

Solana's price stagnation persists despite significant ETF advancements, including revised filings from Grayscale and VanEck. These proposals introduce staking incentives and dual-custodian systems, reflecting institutional efforts to align with regulatory requirements while enhancing SOL's utility.

Snorter Bot Presale Hits $2.7M as Solana-Based Trading Tool Gains Traction in Meme Coin Market

The meme coin market resurgence, now valued at $66 billion with daily volumes exceeding $6.5 billion, has fueled demand for Snorter—a Telegram-based Solana trading bot designed to identify high-potential tokens early. Its presale for SNORT tokens has surpassed $2.7 million amid growing interest in automated meme coin trading tools.

Snorter combines low-latency execution via private RPC nodes with security features including scam detection and MEV protection. The bot enables copy-trading of successful wallets and operates entirely within Telegram, offering an integrated interface for portfolio management without external tools. This approach targets retail traders seeking an edge in the volatile meme coin sector.

Solana Faces Resistance at $100 as GambleFi Project Rollblock Gains Traction

Solana's price struggles below $170 amid broader market weakness, with technical indicators suggesting potential oversold conditions. The Hodler Net Position Change metric surged 102% since July 30, signaling accumulation by long-term investors despite short-term trader exits.

Rollblock emerges as a standout performer, attracting capital flows with its community-driven GambleFi model. Market analysts highlight upcoming CEX listings as a potential catalyst, with $1 price targets gaining credibility as adoption grows.

Realized Profit/Loss Ratio data shows capitulation signals, dropping to 0.15 on August 2 - the lowest monthly reading. This typically precedes market bottoms, with Solana's RSI now at 41.65 approaching oversold territory.

Solana Price Steadies Near $167: Is It The Perfect Buying Opportunity?

Solana's price has rebounded nearly 8% in early August after a sharp 25% decline from July highs. The recovery to $167 reflects improving market sentiment and bullish technical indicators, including a crucial trendline support bounce.

Key drivers include Solana's Seekers Mobile initiative announcement and positive derivatives data. CoinGlass platform shows OI-Weighted Funding Rate flipping positive, signaling growing bullish positioning among futures traders.

The altcoin's resilience comes despite broader macroeconomic concerns, with rising active addresses and strong fundamentals supporting the recovery from July's $155 low after peaking at $206.

Upexi Inc. Doubles Solana Holdings to Over 2M SOL, Fueled by $200M Capital Raise

Upexi Inc. (UPXI), a Tampa-based diversified brand owner, has aggressively expanded its Solana treasury, more than doubling its SOL holdings to over 2 million tokens in July. The company funded the purchases through a $200 million capital raise via common stock and convertible notes, capitalizing on discounted "locked SOL" acquisitions at mid-teens below market rates.

CEO Allan Marshall highlighted the strategic accumulation, including bulk purchases of 100,000 SOL on July 21 and 83,000 SOL three days later. The holdings now generate an 8% staking yield while trading at 0.9x basic market NAV, with shares rallying 56% monthly. "This was a game-changing month," Marshall noted, emphasizing built-in gains from discounted purchases.

Solana Mobile Begins Global Rollout of Seeker Crypto Smartphone

Solana Mobile has initiated worldwide shipments of its second-generation Web3 smartphone, the Seeker, with tens of thousands of units en route to customers across 50+ countries. The $450-$500 Android device has surpassed 150,000 pre-orders, generating over $67 million in gross revenue.

The Seeker builds on lessons from Solana's Saga phone, which gained traction after crypto incentives like airdrops boosted its utility. Its crypto-native features include a dedicated dApp store, integrated wallet, and Seed Vault security system that isolates private keys while maintaining dApp functionality.

"The Seed Vault keeps your private keys and seed phrases completely separate from the main app layer," said Emmett Hollyer, General Manager at Solana Mobile. The launch marks a strategic push to bridge mobile technology with blockchain accessibility.

How High Will SOL Price Go?

BTCC financial analyst Olivia provides a cautious but optimistic outlook for SOL. Based on current technicals and news sentiment, she sees potential for SOL to test the $178.24 resistance (20-day MA) in the near term. A breakout could target the upper Bollinger Band at $202.30. Key factors to watch include:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $163.86 | Below 20-day MA |

| MACD | Bullish crossover | Positive momentum |

| Bollinger Bands | $154.19-$202.30 | Potential range |

Olivia advises monitoring both the $154 support and $178 resistance levels for clearer direction.